PPT LATIHAN SOAL TRANSAKSI FORWARD RATE PowerPoint Presentation, free download ID3237979

A. Pengertian Kurs. Kurs salah satu istilah yang sering digunakan dalam bidang keuangan dan dikenal dengan sebutan nilai tukar (exchange rate).Menurut Kamus Besar Bahasa Indonesia (KBBI) kurs adalah nilai mata uang yang dimiliki sebuah negara yang dinyatakan dengan nilai mata uang negara yang lain.

PPT LATIHAN SOAL TRANSAKSI FORWARD RATE PowerPoint Presentation, free download ID3237979

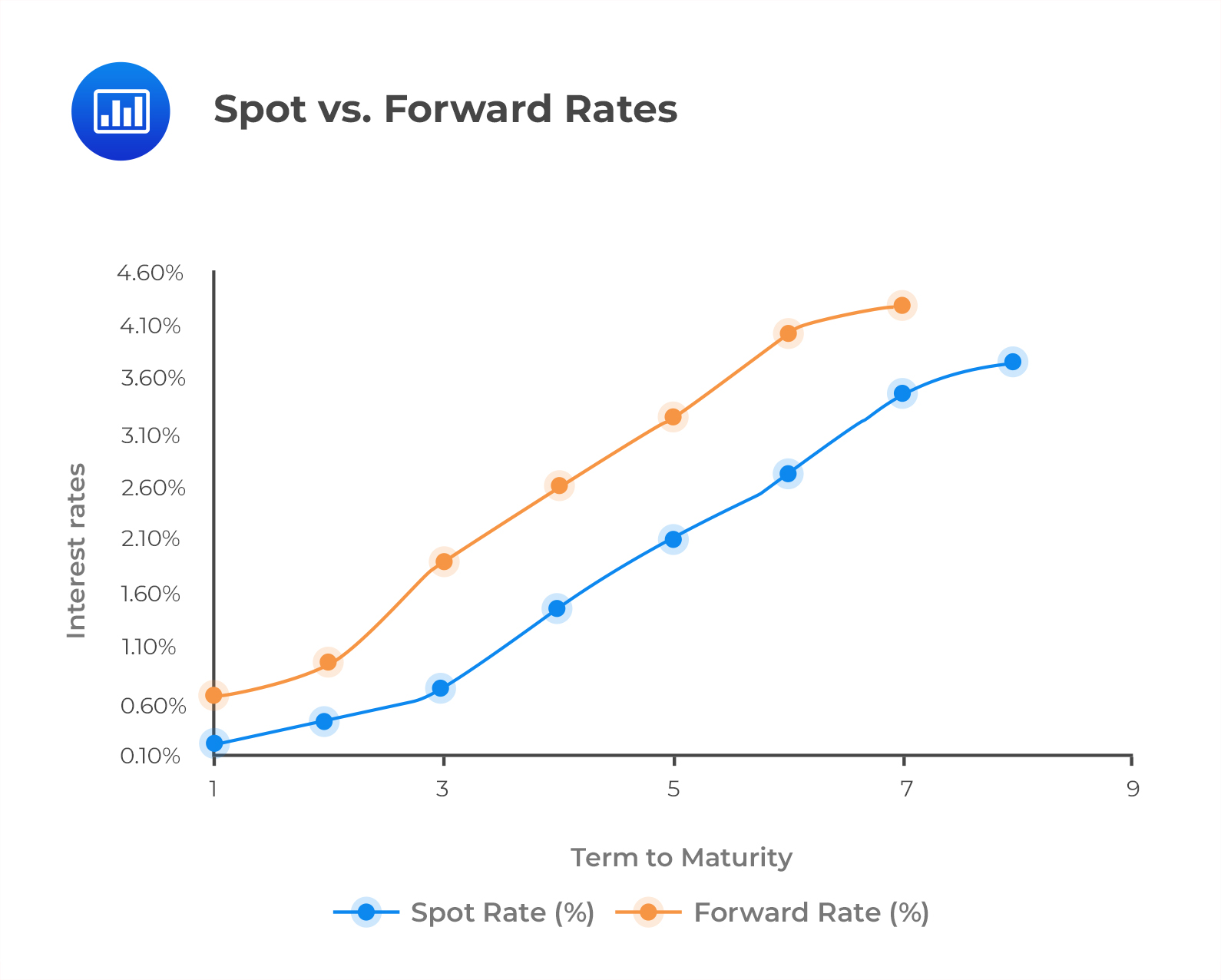

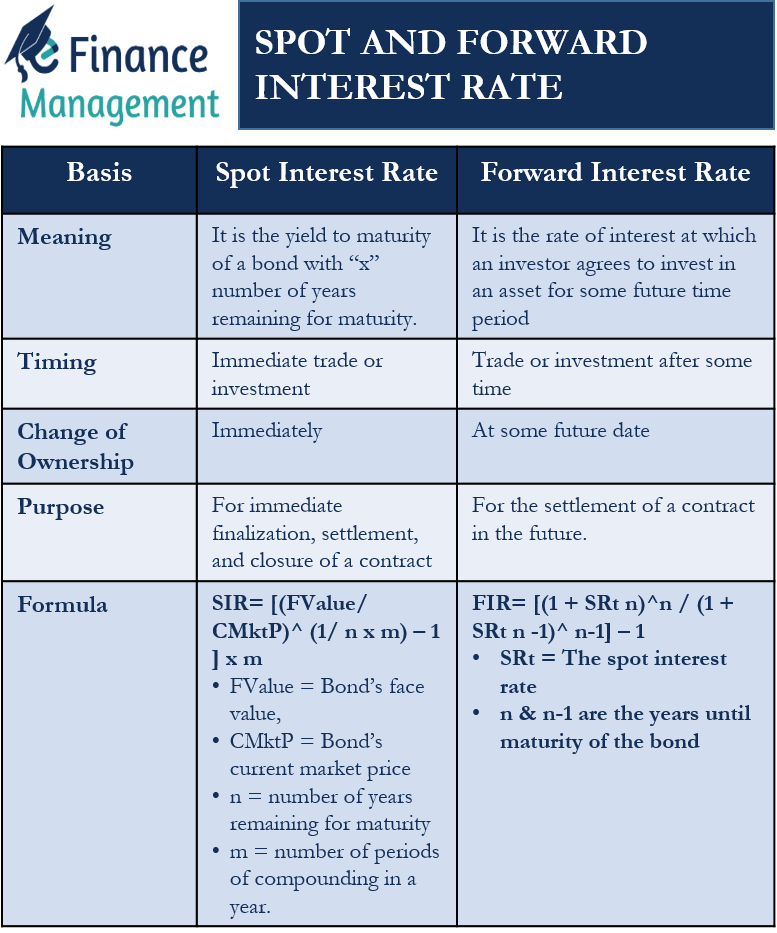

Pahami perbedaan antara kurs spot dan forward rate. Pelajari mengapa seseorang akan masuk ke dalam kontrak dengan kurs spot, bukan kurs forward. Tingkat forward adalah harga penyelesaian kontrak forward, sedangkan kurs spot adalah harga penyelesaian kontrak spot.

Spot, Forward, and Par Rates AnalystPrep FRM Part 1 Study Notes

Spot Rate dipengaruhi oleh kondisi pasar saat ini, sedangkan Forward Rate ditentukan oleh perbedaan suku bunga antara dua mata uang dan waktu penyelesaian transaksi. Contoh Spot Rate. Sebagai contoh, jika Anda membeli USD/EUR pada harga 1.20, ini berarti Anda membayar 1.20 Euro untuk setiap Dolar AS. Harga 1.20 Euro per Dolar AS ini adalah Spot.

Spot and Forward Rates YouTube

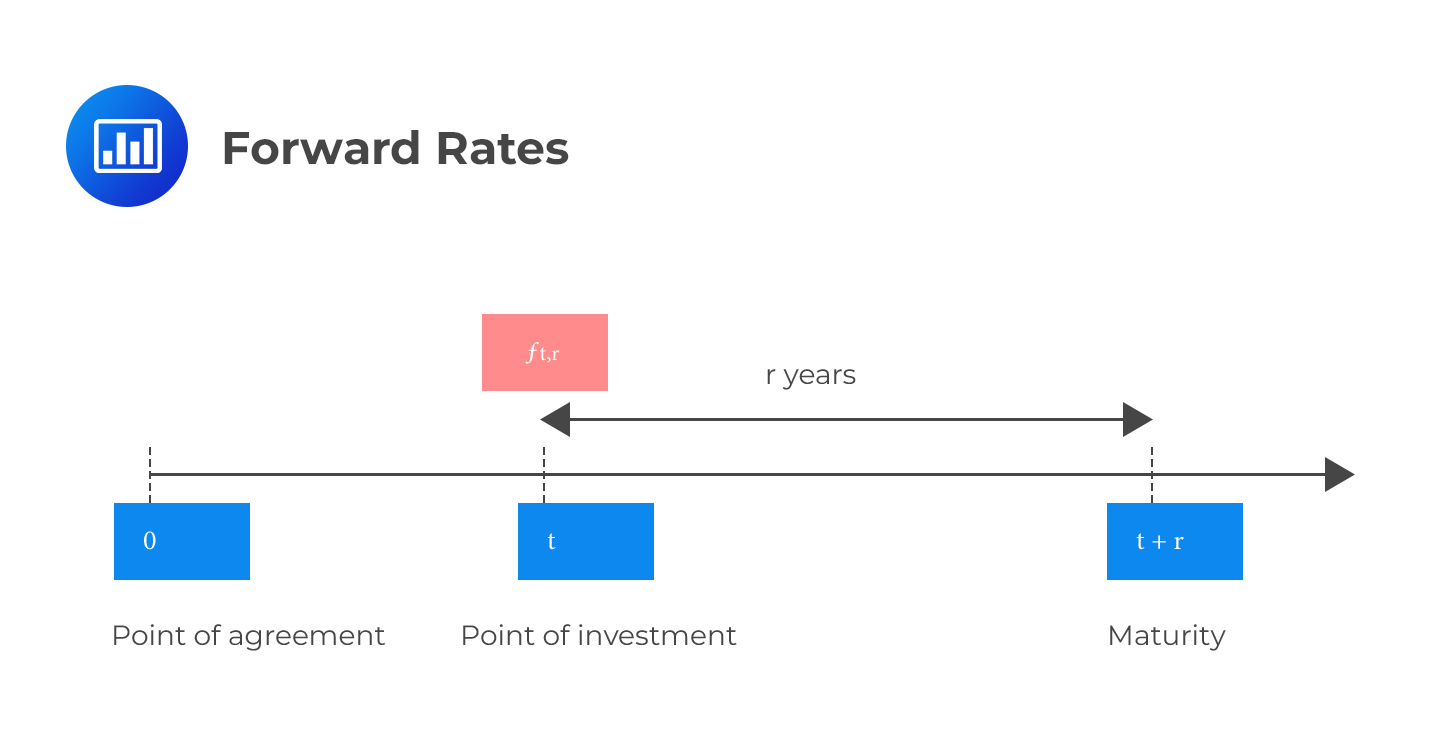

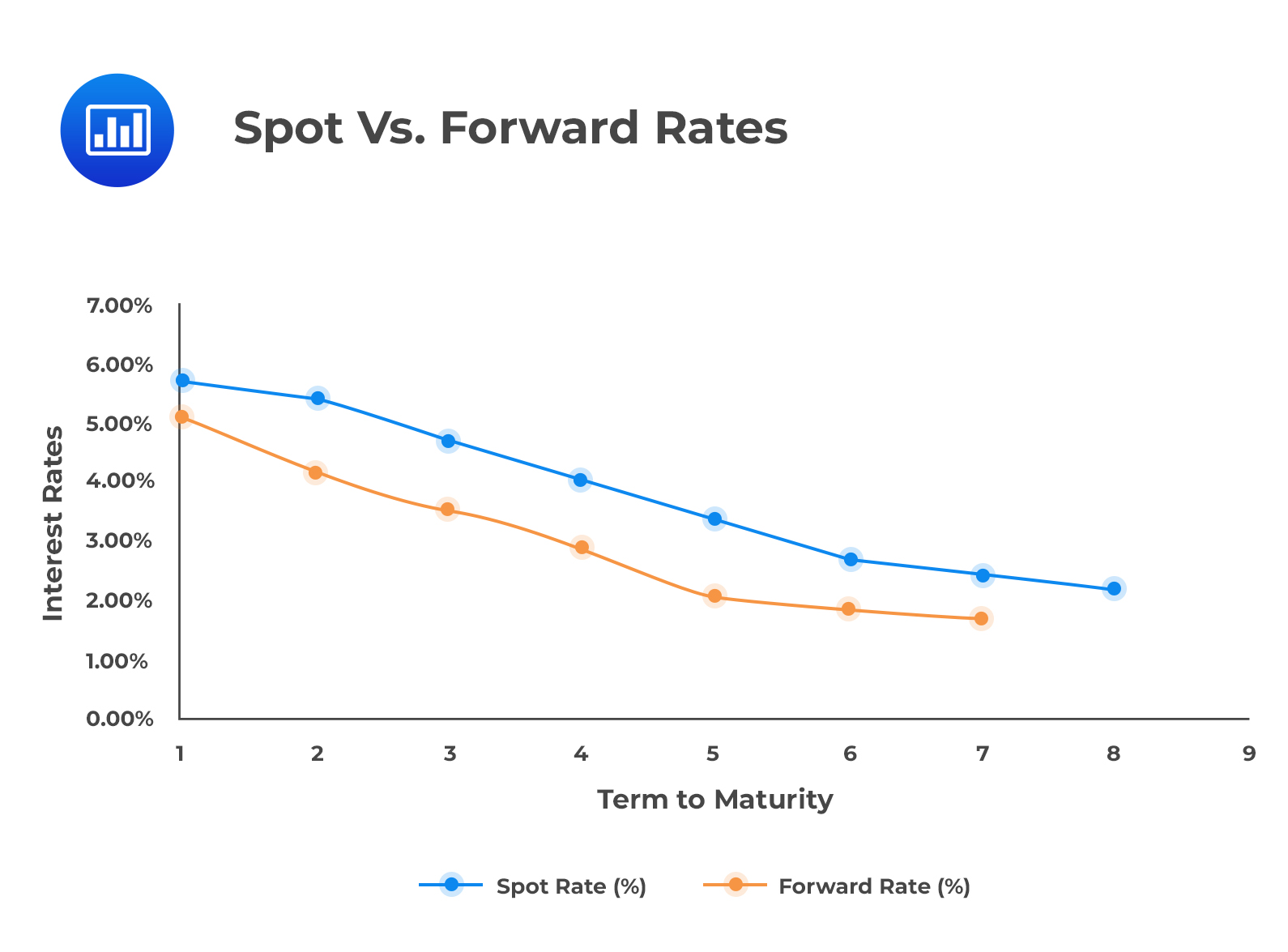

Forward Rates. In theory, forward rates are prices of financial transactions that are expected to take place at some future point. A forward rate indicates the interest rate on a loan beginning at some time in the future, whereas a spot rate is the interest rate on a loan beginning immediately. Thus, the forward market rate is for future.

Incredible Contoh Soal Menghitung Spot Rate 2022 Dikdasmen ID

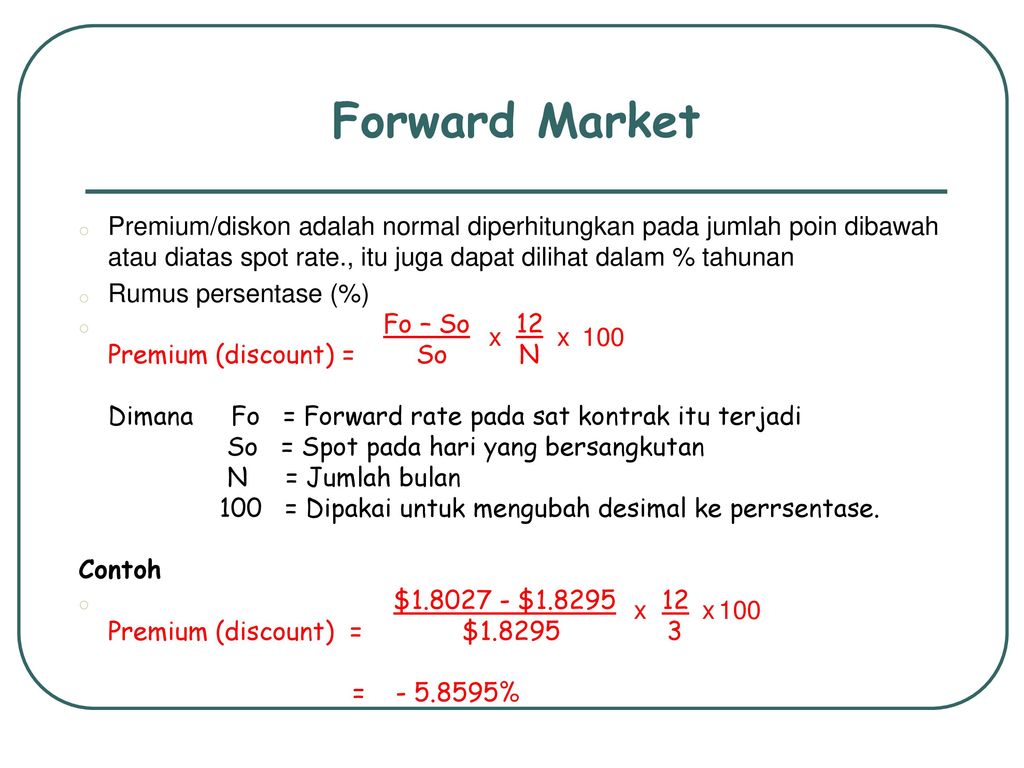

Anda dapat menghitung kurs forward dengan formula berikut: Kurs forward = Kurs spot x (1 + Suku bunga domestik) / (1 + Suku bunga asing) Mari ambil contoh sederhana. Jika kurs spot rupiah per USD adalah adalah 14.000 dan suku bunga rupiah dan USD masing-masing adalah 7,5% dan 0,4% per tahun. Maka perhitungan kurs forward IDR/USD adalah: Kurs.

Spot Rates and Forward Rates CFA, FRM, and Actuarial Exams Study Notes

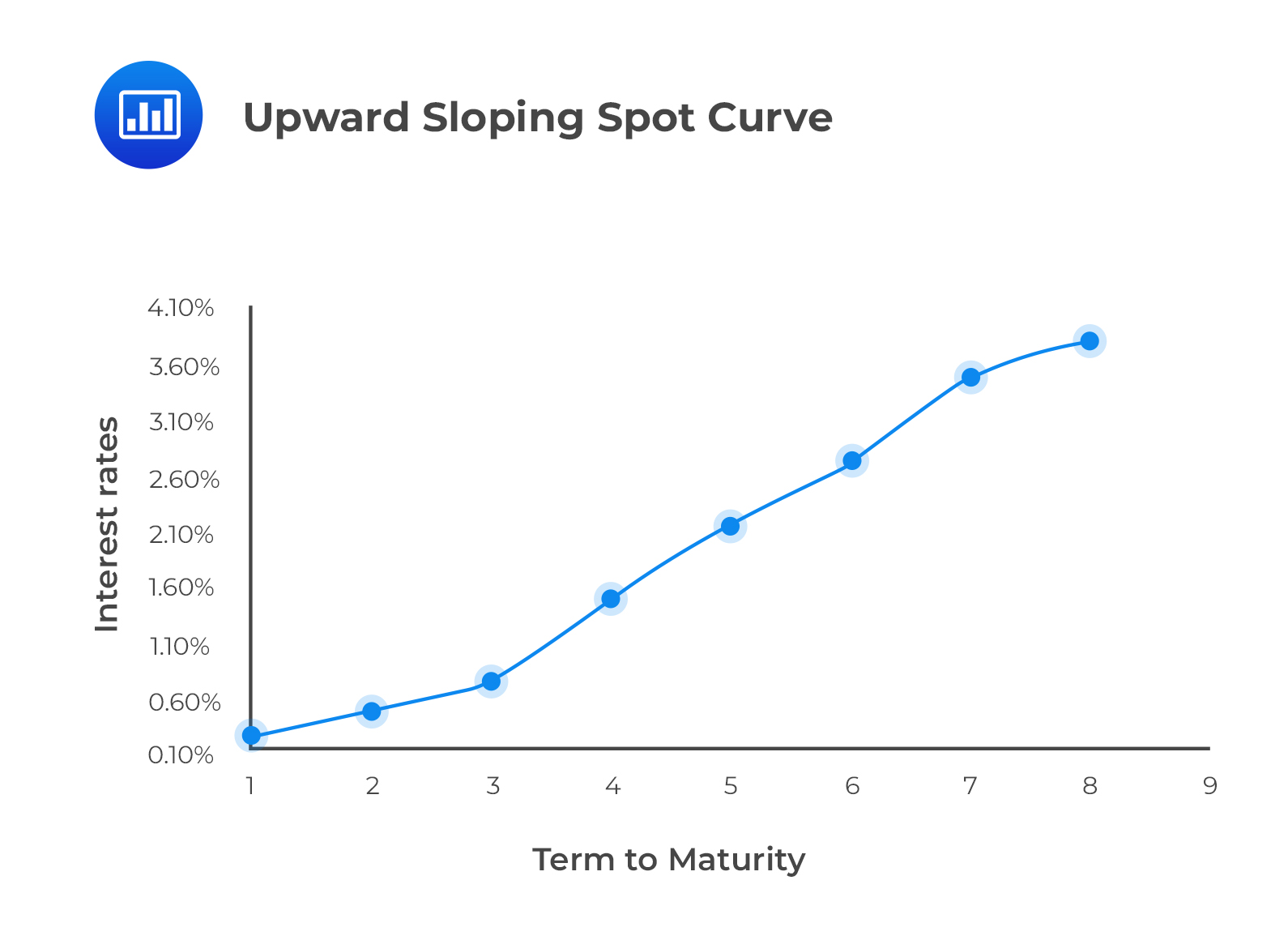

Spot Rate vs. Forward Rates. A spot interest rate gives you the price of a financial contract on the spot date. The spot date is the day when the funds involved in a business transaction are transferred between the parties involved. It could be two days after a trade, or even on the same day, we complete the deal. A spot rate of 5% is the.

Incredible Contoh Soal Menghitung Spot Rate 2022 Dikdasmen ID

Forward Rate = ((1+Ra) Ta /(1+Rb) Tb - 1) = ((1+0.08) 5 /(1+0.06) 3 - 1) = 0.233692695 = 23.37%. Forward Rate vs Spot Rate. The forward yield is the interest rate paid on a bond in the future. On the other hand, the spot rate is the interest rate for future contracts that must be settled and delivered immediately (on the spot) or on the.

Spot Rates and Forward Rates CFA, FRM, and Actuarial Exams Study Notes

Contoh jurnal kontrak serah dengan metode nilai wajar. Kembali ke contoh PT Wahid Husen, dengan menerapkan rumus di atas nilai wajar kontrak serah pada tanggal 1 Agustus 2018 (saat dimulainya kontrak) adalah Rp0 [= USD1.000.000 × (Rp13.200 - Rp13.200)/ (1 + 5%/12) 3 ]. Pada saat dimulainya kontrak, nilai wajar adalah nol.

[Solved] The /€ spot exchange rate is 1.50/€ and the 90day forward... Course Hero

LATIHAN SOAL TRANSAKSI MATA UANG ASING DAN FORWARD/FUTURE CONTRACT UNTUK SPEKULASI DAN HEDGING. 1 Nov 19 1 Des 19 31 Des 19. 1 Feb 20 1 Mar 20. Spot rate 11 13 13 14 14. Forward rate 30days 12 12 13 13 13. Forward rate 60days 11 12 13 13 13. Forward rate 90days 12 12 13 12 13. Forward rate 120days. 12 13 14 13 13.

Assumptions Relating to the Evolution of Spot Rates CFA, FRM, and Actuarial Exams Study Notes

4. Risiko Kredit. 5. Regulasi yang Berlaku. 6. Contoh pasar spot dan pasar forward. Pasar spot dan pasar forward adalah dua jenis pasar keuangan yang memiliki perbedaan cara kerja yang mendasar. Kedua pasar ini sering digunakan oleh trader untuk meraih peluang profit trading atau melindunginya dari risiko.

Calculate spot rates from par rates using Excel YouTube

A forward interest rate acts as a discount rate for a single payment from one future date and discounts it to a closer future date. Theoretically, the forward rate should be equal to the spot rate.

How to calculate Forward rates based on Spot rates (FRM) YouTube

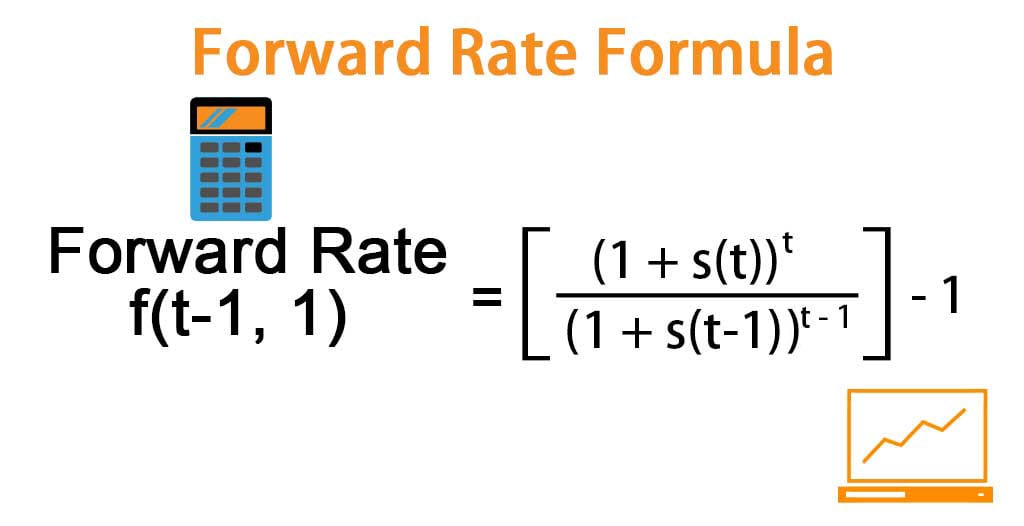

Implied Forward Rates. Implied forward rates (forward yields) are calculated from spot rates. The general formula for the relationship between the two spot rates and the implied forward rate is: $$ (1+Z_A)^A×(1+IFR_{A,B-A} )^{B-A}=(1+Z_B )^B $$ Where IFR A,B-A is the implied forward rate between time A and time B. Example: Computing an Implied.

Forward Rate Formula Formula Examples with Excel Template

A forward rate is the future price a currency trader agrees to or the yield on a bond on a future date. In commodities futures markets, the spot rate is the price for a commodity being traded.

Spot and Forward Interest Rates Meaning, Key Differences, Hypotheses

significant effect toward Future Spot Rate, this was indicated by the regression coefficient value of -18.28879 and a significance value of 0.0005. Spot Rate and Estimated Forward Rate simultaneously affect the Future Spot Rate, this was indicated by the value of the F-statistic of 30.45657 and a significance value of

Contoh Soal Kontrak Forward

Forward Rate = [ (1 + S1)n1 / (1 + S2)n2]1/ (n1-n2) - 1. where S1 = Spot rate until a further future date, S 2 = Spot rate until a closer future date, n1 = No. of years until a further future date, n 2 = No. of years until a closer future date. The notation for the formula is typically represented as F (2,1), which means a one-year rate two.

Freight Contract Rates & Spot Rates Explained Difference Between Spot Rates and Forward Rates

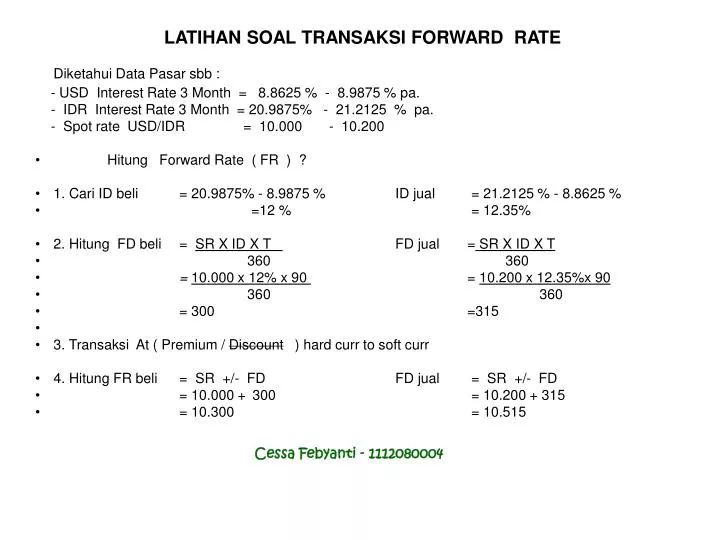

LATIHAN SOAL TRANSAKSI FORWARD RATE Diketahui Data Pasar sbb : - USD Interest Rate 3 Month = 8. 8625 % - 8. 9875 % pa. - IDR Interest Rate 3 Month = 20. 9875% - 21. 2125 % pa.